By Greg Heym, Brown Harris Stevens Chief Economist and host of Crossing The Line

Today, we discuss the Fed's latest move, but first pay tribute to the men and women who have kept this great nation free.

Thank You Veterans

This Monday, we honor those who have served this great country. Each year, I struggle to find words that truly convey my gratitude to all our veterans. What can you say to people that have sacrificed so much, and risked their lives to keep you safe and free?

Let me start by conveying a sincere thank you. I hope veterans hear that enough, as they have certainly earned that respect. I think there’s a lot more we can do for our veterans, especially when it comes to health care and housing assistance. Veterans have held up their end of the bargain, it’s time we as a nation did our part.

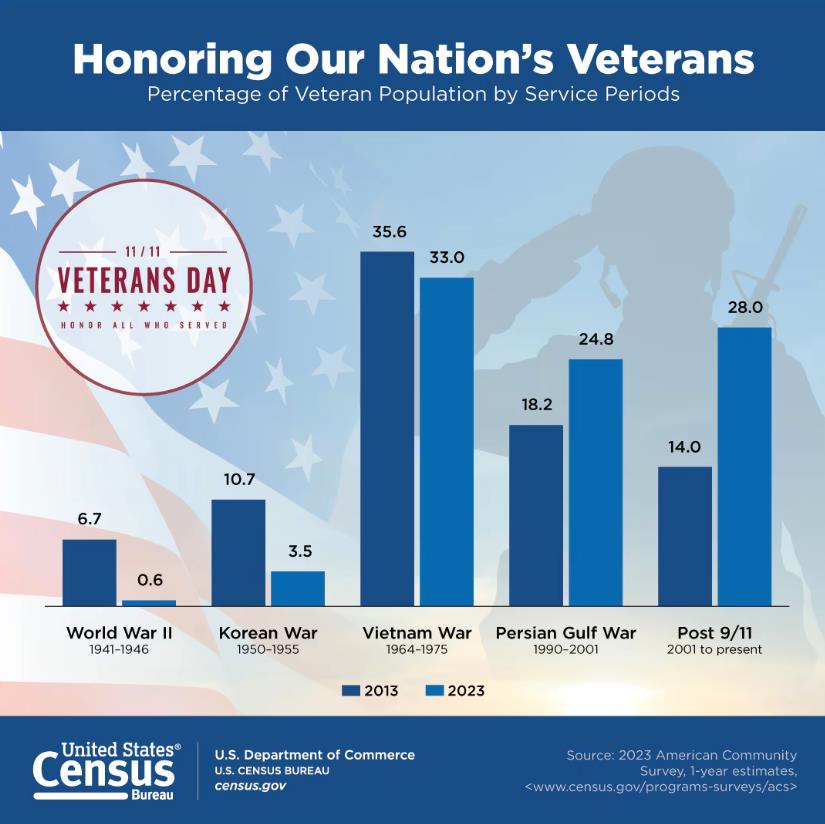

Since this is an economics blog, I thought it would be interesting to show the breakdown of veteran population by service periods, courtesy of the Census Bureau.

The Fed Cuts Rates By 0.25%

Since inflation continues to move towards their 2% annual goal, the Fed feels comfortable cutting rates even though economic growth was a solid 2.8% last quarter. Since rate cuts can take as long as six months to a year to help the economy, the Fed doesn’t have the luxury of waiting for signs of an imminent recession to act.

While it’s great the Fed is cutting short-term rates, consumers have yet to see any real decline in lending rates. Credit card rates have barely moved since the Fed’s 50-basis point cut in September. Neither have car loans, with the average rate on a 5-year loan down by just 0.1%.

Then there’s mortgage rates. Since falling to 6.08% at the end of September, the average 30-year conforming mortgage rate has risen for six straight weeks to 6.79%. That’s still about 1% lower than the average rate over the past 50 years, and lower than the 7.5% average a year ago, but that’s no comfort to would-be homebuyers out there.

Remember that mortgage rates are not set by the Fed, but rather by yields on U.S. Treasuries, most notably 10-year ones. So, any changes the Fed makes to short-term rates have no direct impact on 30-year rates. For more information on this topic, here is a good summary, courtesy of the Wall Street Journal.

What will bring mortgage rates down? A combination of lower inflation and a cooling economy would do the trick. The problem so far is the economy—particularly the labor market—keeps outperforming expectations.