Gregory Heym is Chief Economist at Brown Harris Stevens. His weekly series, The Line, covers new developments to the economy, including trends and forecasts. Read on for the latest report and subscribe here to receive The Line in your inbox.

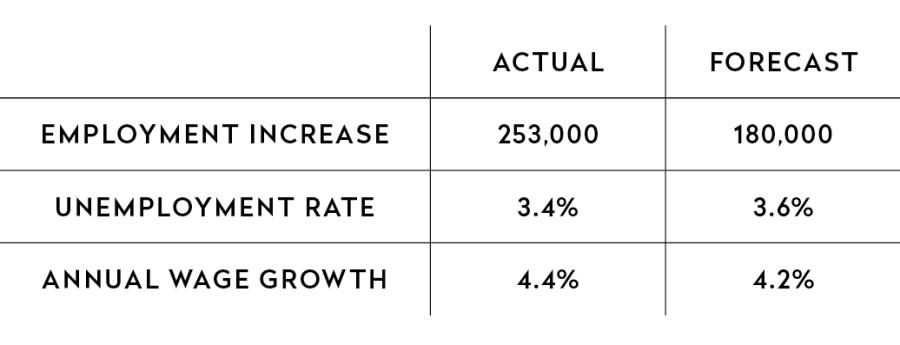

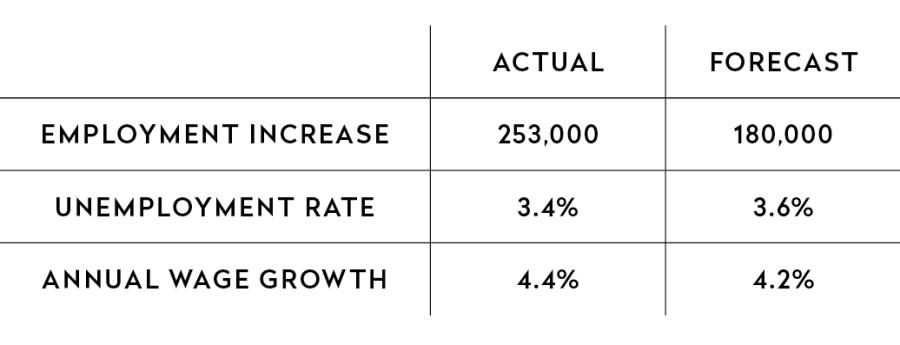

The labor market keeps going like the Energizer bunny, with 253,000 jobs added last month. Here are the big takeaways from the April employment report:

You’ll notice that all three of these numbers were better than expected, so it’s all good so far. There were two areas that are a bit concerning:

- The employment gains for February and March were revised down by a total of 149,000. That’s a big revision, but the economy still added 413,000 jobs in those two months, so I wouldn’t worry too much about it.

- The labor force participation rate—the percentage of people 16 and older who are working or actively looking for work— was unchanged at 62.6%. Since there are still 9.6 million unfilled jobs out there, we need more people to reenter the workforce. While total employment has surpassed its pre-pandemic level, the labor force participation rate is still lower than it was in February 2020 (63.3%).

While not as brisk as last year, hiring has remained strong so far in 2023 despite growing concerns of a recession later this year. We keep hearing about layoffs from large companies, but jobless claims were at just 242,000 last week, so smaller firms keep picking up the slack. I don’t expect that this report will change what the Fed has planned—see below for the latest on Fed hikes—but next week’s inflation reports certainly could.

The Fed Hikes Another 0.25%

The Federal Reserve raised rates for the 10th time since March 2022, bringing the Federal Funds rate up 25 basis points to a range of 5%-5.25%. This move was expected, and it most likely marks the end of rate hikes for now. I know I won’t miss them, how about you?

The past year has been a rough one for anyone looking to borrow money. Here is summary of what’s happened to rates since March 2022:

Credit card rates are were pulled from the Fed, mortgage rates from Freddie Mac, and auto and personal rates from Bankrate via CNBC.

The big question now is if/when the Fed starts cutting rates. It’s typical for the Fed to cut rates in a recession to help get the economy going again. And it seems pretty clear we are heading towards a recession at the end of this year. That said, the Fed can’t think about raising rates in 2023, as inflation—although moving in the right direction—is still too high. Chairman Powell has made this clear, but many analysts aren’t listening.

The market for federal funds futures contracts is betting on rate cuts starting this September. I can see why they might not be so quick to believe the Fed’s commitment to beating inflation, but I think anyone expecting them to reverse course in the next couple of months will be very disappointed. Rate cuts are coming, but not until 2024.

Many of you might wonder what this latest Fed action means for mortgage rates. The answer is not much. Thirty-year mortgage rates are based on inflation expectations, not what the Fed does to short-term rates. So, next week’s report on consumer prices will give us a better picture of where rates are headed.

Happy Birthday, Billy!

Happy Birthday, Billy!

I’d like to close today by wishing my brother Billy a very happy birthday.

I won’t say how old he is, but I will point out he is 5 years older than me. Happy birthday!